Vea también

10.06.2024 12:17 PM

10.06.2024 12:17 PMAnalysis:

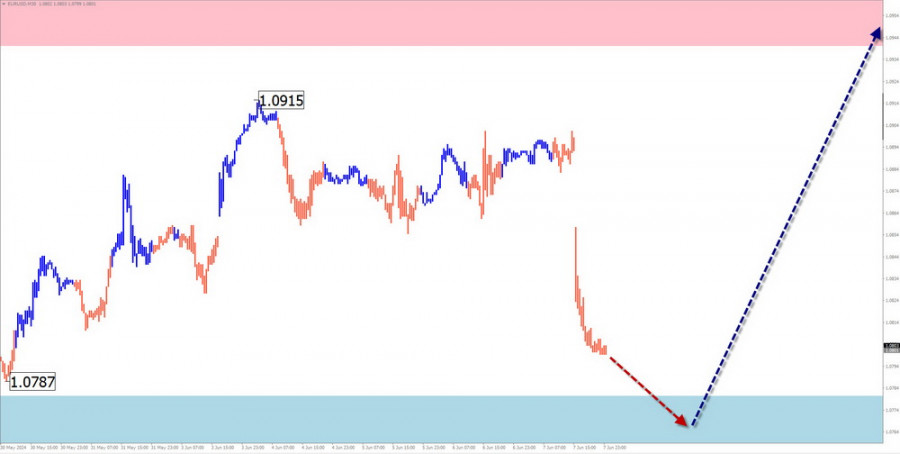

A short-term analysis of the euro chart since April of this year shows a dominant upward trend. In the wave structure, a corrective phase has been developing over the past few months and is still ongoing. Prices are approaching the lower boundary of the price corridor. Before continuing to rise, the instrument needs to gain an additional wave level to complete the correction.

Forecast:

The euro is expected to be more volatile in the coming week. By mid-week, a reversal and upward movement are anticipated from the support zone. The calculated support indicates the most likely area for the correction to end.

Potential Reversal Zones:

Recommendations:

Analysis:

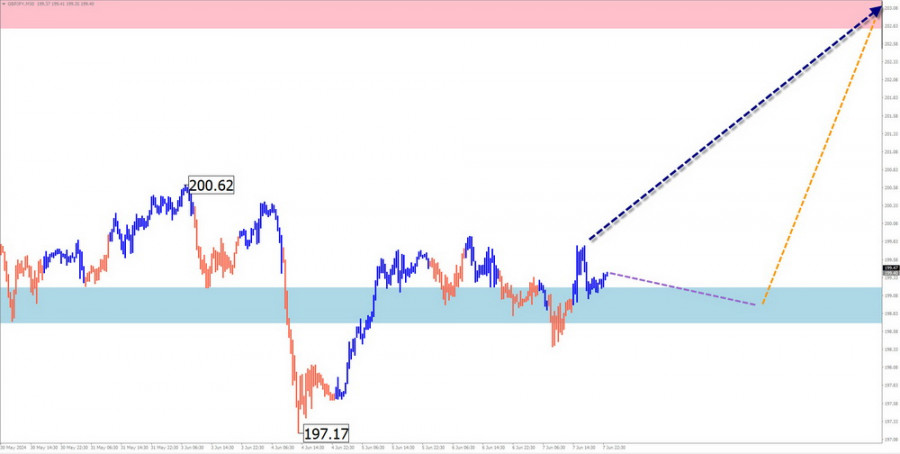

Since December of last year, an upward wave has set the dominant direction of the Japanese yen's main pair. Since the end of April, a counter-correction has been developing in the wave structure. The analysis shows this correction still needs to be completed. In recent weeks, prices have been moving within the formed price corridor, creating a "horizontal pennant" pattern.

Forecast:

At the beginning of the coming week, the current sideways movement is likely to continue, with a gradual decline in prices towards the support area. Closer to the weekend, increased volatility, a reversal, and a resumption of price growth can be expected. The calculated resistance may slow the rise within the weekly range.

Potential Reversal Zones:

Recommendations:

Analysis:

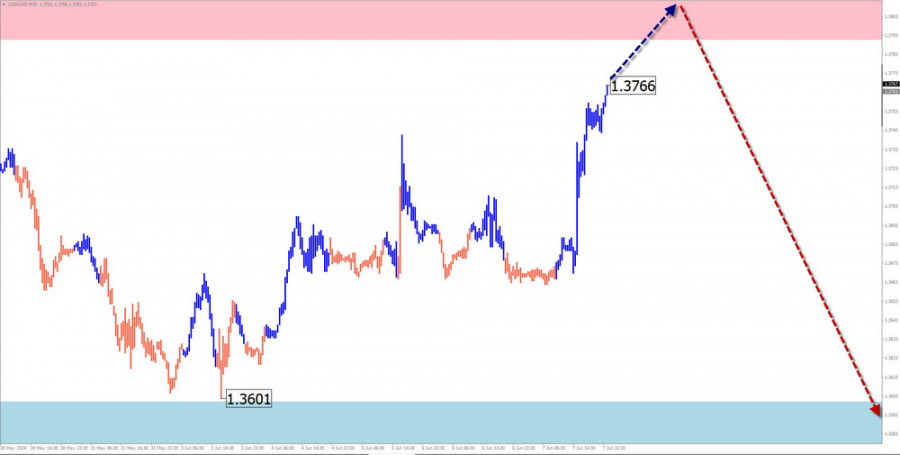

The pound/yen pair continues its upward movement. The wave structure is developing a counter-correction, forming a "shifting plane" pattern on the chart. The price moves along the lower boundary of the weekly support zone. Wave analysis logic indicates the need to form a correction.

Forecast:

After probable pressure on the resistance zone at the beginning of the week, a directional change of the cross is expected, with a gradual decline to the calculated support boundaries. The highest volatility is likely closer to the weekend.

Potential Reversal Zones:

Recommendations:

Analysis:

The daily chart analysis of the Canadian dollar major shows the formation of a "horizontal pennant" pattern since April of this year. As of the analysis, the wave structure needs to be completed. No signs of an imminent reversal are observed on the chart. Prices are approaching the upper boundary of the intermediate support zone of the larger time frame.

Forecast:

In the coming days, an attempt to pressure the resistance zone can be expected. Subsequently, a price reversal and resumption of the downward movement are anticipated. The pair's decline is expected to reach the intermediate support zone boundaries of the daily time frame.

Potential Reversal Zones:

Recommendations:

Brief Analysis:

The downward price movement of the New Zealand dollar since December of last year continues to form the main price direction. The upward segment of the last two months remains within the corrective phase. Within this phase, since mid-May, the price forms an intermediate correction as a shifting plane.

Weekly Forecast:

At the beginning of the coming week, the downward vector is expected to end, and price fluctuations will transition into a sideways pattern within the calculated support zone. After reversal conditions form, a directional change can be expected, with price growth reaching the calculated resistance boundaries.

Potential Reversal Zones:

Recommendations:

Analysis:

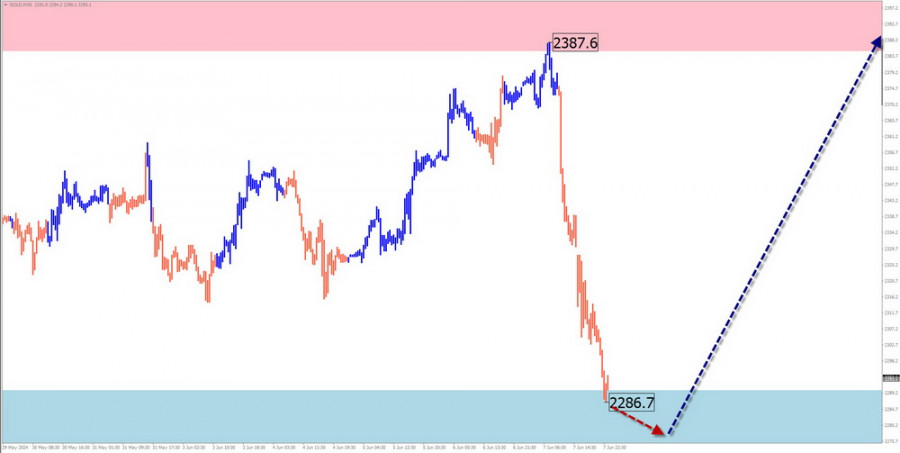

A bullish trend has set the price direction of gold since October of last year. Since the end of April, gold prices have been moving sideways within the strong resistance of the weekly time frame. The wave structure appears complete, but no confirmed reversal signals are observed on the chart. The price is near the lower boundary of the formed corridor.

Forecast:

The current sideways trend of gold prices may continue into the coming week. There is a high probability of pressure on the calculated support. A brief breach of the upper boundary is not excluded. By the end of the week, the likelihood of a reversal and a resumption of price growth increases.

Potential Reversal Zones:

Recommendations:

In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed on each time frame. Dotted lines show expected movements.

Attention: The wave algorithm does not account for the duration of instrument movements in time!

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Lo más probable es que se esté formando una tendencia alcista mayor en el panorama global del SP500, cuya estructura es similar a la del impulso. Si nos fijamos

La estructura de ondas del instrumento GBP/USD sigue siendo bastante complicada y muy confusa. Alrededor del nivel de 1.2822, que corresponde al 23.6% de Fibonacci y está cerca del pico

El patrón de onda para el instrumento GBP/USD sigue siendo bastante complicado y confuso. Un intento exitoso de romper el nivel de Fibonacci del 50,0% en abril indicó

El patrón de onda para el instrumento GBP/USD sigue siendo bastante complicado. El intento exitoso de romper el nivel de Fibonacci del 50,0% en abril indicó que el mercado está

El patrón de onda del gráfico de 4 horas para el instrumento EUR/USD se mantiene sin cambios. En este momento, estamos observando la construcción de la onda esperada

El análisis de ondas del gráfico de 4 horas para el par euro/dólar sigue siendo bastante claro. Durante el año pasado, solo hemos visto tres estructuras onduladas que se alternan

InstaForex en cifras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.