یہ بھی دیکھیں

30.09.2022 11:27 AM

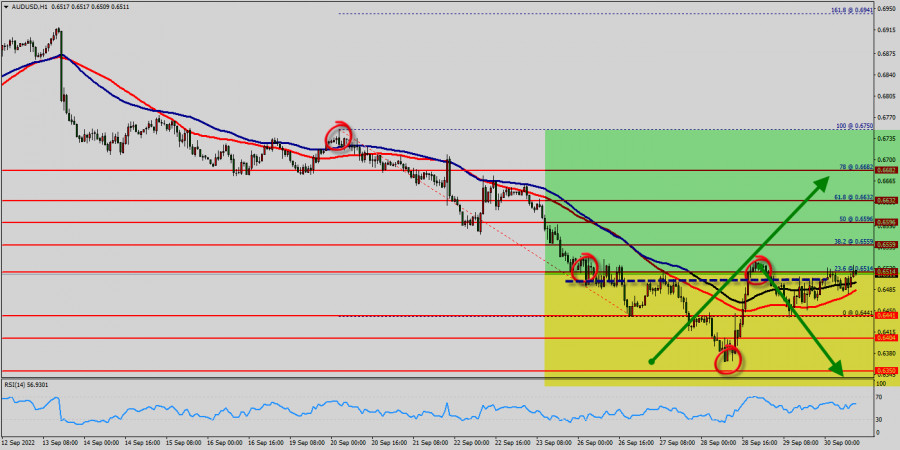

30.09.2022 11:27 AMThe general trend of the AUD/USD pair is still stronger to the downside. Investors will not care about the arrival of technical indicators towards oversold levels as far as interacting with the factors of the gains of the AUD dollar and the continued faltering of the USD. The closest bearish targets are currently 0.6441 and then the parity price for the currency pair. New targets 0.6404, 0.6350 and 0.6300 (historical target). AUD/USD pair is expected to trade around the spot of 0.6441 and 0.6460 by started of this week, according to trading economics global macro models and our expectations. Looking forward, we estimate it to trade at 0.6441 in or Sept. 2022. The pair dropped from the level of 0.6514 (this level of 0.6514 coincides with the ratio of 23.6%) to the bottom around 0.6441. Today, the first resistance level is seen at 0.6514 followed by Yesterday (the weekly pivot point), while daily support 1 is found at 0.6404. Also, the level of 0.6514 represents a weekly pivot point for that it is acting as major resistance/support this week. Some follow-through selling would make the AUD/USD pair vulnerable to challenging the valence mark in the near term. From a technical perspective, the overnight swing low, around the 0.6441 area, now seems to act as a support point, below which spot prices could extend the fall towards the 0.6404 mark. The AUD/USD pair continues to move downwards from the level of 0.6350. For these reasons we would be very difficult to see further significant decline for the euro before tomorrow, with signs of stabilization and correction to be the most possible scenario. A choppy morning saw the AUD/USD pair fall to an early morning low of 0.6441 before rising to a high of 0.6514 (pivot point). An extended rally could test resistance at 0.6441 and the second major resistance level (R2) at 0.6559. The third major resistance level (R3) sits at 0.6596. The direction of the AUD/USD pair may reflect the strength of either the EU or AUD economy. Moreover, the EUR to AUD dollar rate may reflect the overall global market sentiment. We had already shared in our previous topic that the psychological price sets at the level of 0.6514. The AUD/USD weekly forecast is mildly tilted towards the downside as the pair failed to sustain above the 0.6514 area after several attempts. The AUD/USD pair weekly forecast is mildly tilted towards the downside as the pair failed to sustain above the 0.6514 area after several attempts. If the price were to depress the resistance 0.6514 in the short term, this would be a sign of possible consolidation in the short term, but against the trend trading would then perhaps be riskier. Moreover, the moving average (100) starts signaling a downward trend; therefore, the market is indicating a bearish opportunity below 0.6514. So, it will be good to sell at 0.6514 with the first target of 0.6404. It will also call for a downtrend in order to continue towards 0.6350. The strong weekly support is seen at 0.6350. Sellers would then use the next support located at 0.6325 as an objective. Crossing it would then enable sellers to target 0.6300.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.

سونا 17 جولائی سے بننے والے ڈاؤن ٹرینڈ چینل کے نیچے اور 2,384 کی کم ترین سطح پر پہنچنے کے بعد بننے والے اپ ٹرینڈ چینل کے اندر تقریباً 2,402.86

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

تعداد میں انسٹا فاریکس

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.