Lihat juga

07.03.2025 12:12 PM

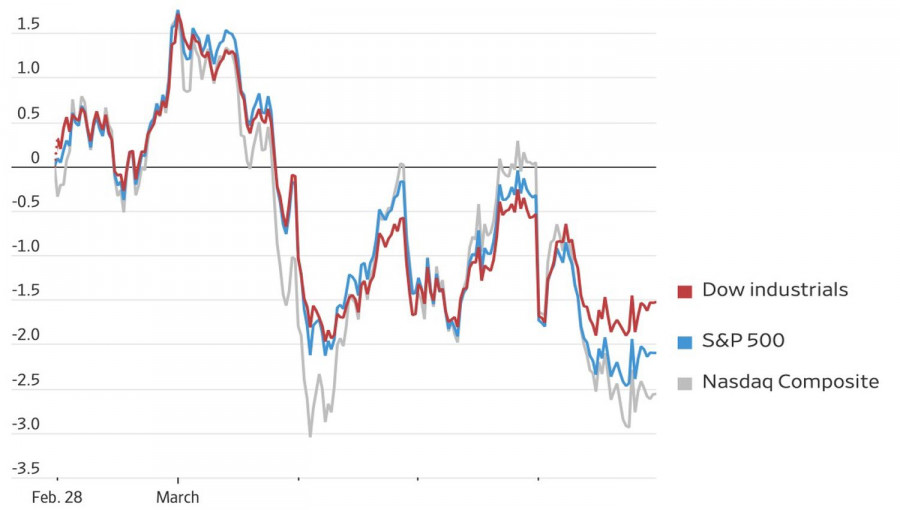

07.03.2025 12:12 PMThere will be no lifeline. The S&P 500 continues to send distress signals, but Donald Trump is not paying attention or at least pretends not to. In one of his speeches, the US president stated that he did not care about what was happening in the American stock market because, in the long run, the economy would strengthen, so investors had nothing to worry about. On another occasion, the Republican claimed that globalists were behind the stock market sell-off, accusing them of being envious of the United States.

US Stock Market Trends

A scapegoat can always be found. For Donald Trump, it is once again China. Beijing was blamed for the COVID-19 pandemic, and now it is accused of triggering the US stock market's decline. The story of China's DeepSeek was the catalyst for investors fleeing American tech stocks. It is no surprise that the Magnificent Seven were the first to enter correction territory, followed by the Nasdaq 100. Now, a 10% drop in the S&P 500 from its February highs seems inevitable.

Trump's theory about globalists deserves attention. However, the record highs in stock indexes after the US presidential election were driven by hopes for economic acceleration and the assumption that the White House would act as a safety net for the S&P 500 in case of a steep decline. Neither of these expectations is materializing.

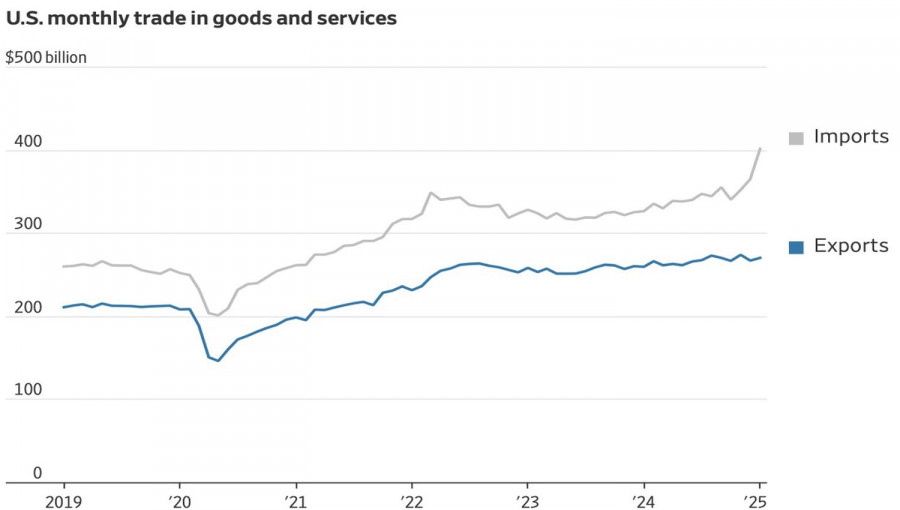

The more economic data comes in, the more concerns grow about the US economy. The disappointing February ADP employment report was followed by bleak trade balance figures. The front-loading of imports ahead of Trump's tariff hikes led to a record US trade deficit in January—34% higher than in December.

US Trade Balance

Net exports may drag down GDP growth, making the Atlanta Fed's forecast of a US economic contraction in the first quarter increasingly realistic. The urge to offload toxic US assets is rising, leaving the S&P 500 with little choice but to fall.

News that the White House exempted some goods from the 25% tariffs under the North American Free Trade Agreement (NAFTA) did not provide lasting relief. The exemption covers 50% of imports from Mexico and 38% from Canada. The S&P 500 briefly rebounded but quickly resumed its decline. Without White House support, whether against globalists' alleged manipulations or fears of an approaching recession, the US stock market has little chance of recovery.

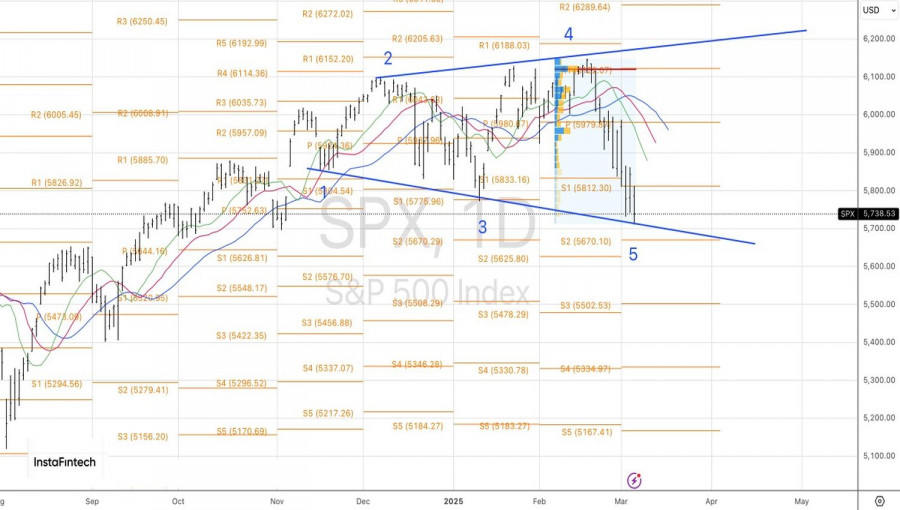

Technically, on the S&P 500 daily chart, the Broadening Wedge pattern has been activated based on the Three Indians pattern. Point 5 could be located significantly lower. As long as the broad-market index trades below 5,800, selling remains the preferred strategy.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Dolar A.S. mengukuh berbanding sejumlah mata wang global, begitu juga pasaran saham A.S., selepas laporan bahawa kerajaan China sedang mempertimbangkan untuk menggantung tarif 125% terhadap beberapa jenis import A.S. Langkah

Permulaan rundingan sebenar boleh menyebabkan penurunan ketara dalam harga emas dalam masa terdekat. Dalam artikel-artikel terdahulu, saya mencadangkan bahawa harga emas yang sebelum ini meningkat dengan ketara boleh mengalami pembetulan

Pada hari Khamis, pasangan mata wang GBP/USD diniagakan lebih tinggi, kekal berhampiran paras tertinggi 3 tahun. Walaupun pound British menaik kukuh dalam beberapa bulan kebelakangan ini, pembetulan masih jarang berlaku

Pasangan mata wang EUR/USD meneruskan dagangan secara tenang pada hari Khamis, meskipun tahap volatiliti kekal agak tinggi. Minggu ini, dolar AS menunjukkan beberapa tanda pemulihan—sesuatu yang boleh dianggap sebagai satu

Analisis Laporan Makroekonomi: Beberapa acara makroekonomi dijadualkan pada hari Jumaat, tetapi ini tidak penting, memandangkan pasaran terus mengabaikan 90% daripada semua penerbitan. Antara laporan yang lebih atau kurang signifikan hari

Minggu lalu, Bank of Canada mengekalkan kadar faedah tidak berubah pada paras 2.75%, seperti yang dijangkakan. Kenyataan yang dikeluarkan bersama keputusan tersebut bersifat neutral, menekankan ketidaktentuan yang berterusan. Sukar untuk

Presiden Amerika Syarikat, Donald Trump sekali lagi memberikan komen mengenai Pengerusi Rizab Persekutuan, Jerome Powell, secara terbuka menyatakan rasa tidak puas hati dengan kadar pemotongan kadar faedah. Satu lagi ungkapan

Corak grafik

petunjuk.

Notices things

you never will!

Carta Forex

Versi-Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.