CHFHKD (Swiss Franc vs Hong Kong Dollar). Exchange rate and online charts.

Currency converter

27 Mar 2025 04:14

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CHF/HKD currency pair is the cross rate against the U.S. dollar, which is not very popular on Forex market. As you can see, the U.S. dollar is not present in this currency pair, but it still greatly affects CHF/HKD. Just combine the USD/CHF and USD/HKD charts in the same price chart and you will get the approximate CHF/HKD chart, which proves graphically their interdependence.

Both currencies are under the strong influence from the U.S. dollar. Therefore, for a better forecasting of the future movement of this currency pair, you need to keep in mind the major indicators of the U.S. economy. These indicators include the interest rate, GDP, unemployment, new workplaces indicator and others. Please note that the Swiss franc and the Hong Kong dollar can react in a different way on changes in the economic situation of the United States.

The Swiss economy has been highly developed for several centuries. Thus, the Swiss franc is known as one the most reliable and stable of the world currencies. Because of the reason that this currency is the safest for the capital investment, that is the reason for the capital inflows to this country during the time of the economic crisis, which provokes the sharp increase of the Swiss franc value against other currencies. Don’t forget this peculiarity of the Swiss economy while trading this financial instrument.

To date, the Hong Kong dollar value is attached to the U.S. dollar. The rate of the U.S. dollar against the Hong Kong dollar is from 7.75 to 7.85.

Hong Kong has one of the largest stock exchanges in the world. Thanks to some factors, Hong Kong leaves behind the number of the major European and American stock exchanges. Today the Hong Kong Stock Exchange is regarded as a leader among the financial centers all over the world.

The economy of Hong Kong is characterized by the free trade, low tax rates and the government policy of the non-interference in the state economy. Because of its shortage in mineral and food resources, the economy of this country is highly dependent from these factors. The state revenue is provided by the service sector, the reexport from China and the well developed tourism sector.

In comparison with the major currency pairs such as EUR/USD, USD/CHF, GBP/USD and USD/JPY, this one is relatively illiquid. So when you predict the future movement of this currency pair, you should pay special attention to the currency pairs that consist of the Swiss franc and the Hong Kong dollar in tandem with the U.S. dollar.

Please remember that the spread for cross currency pairs is usually higher than for the more popular ones. Therefore, before dealing with the cross rates read and understand the broker’s conditions for this specified trade instrument.

See Also

- USD/JPY. Analysis and Forecast

Author: Irina Yanina

11:42 2025-03-26 UTC+2

1588

Gold maintains a positive tone today, but lacks strong bullish momentumAuthor: Irina Yanina

11:54 2025-03-26 UTC+2

1588

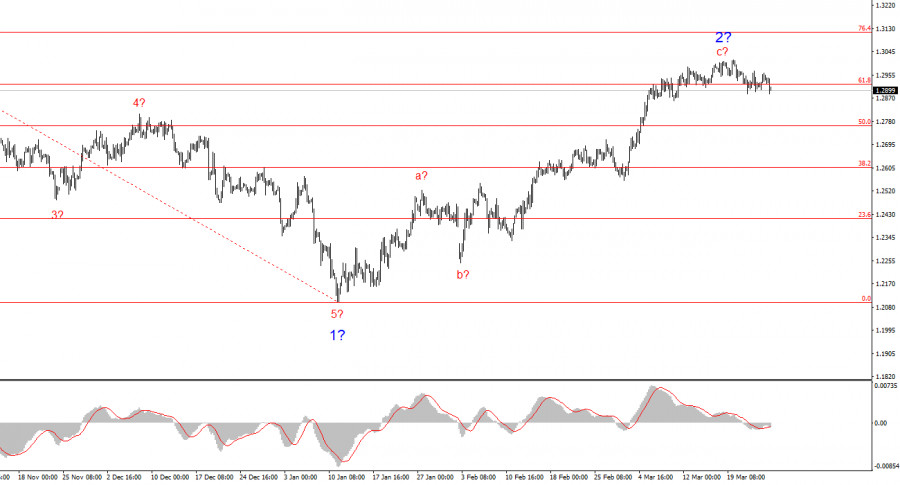

Bulls pushed for two weeks, but now it's time for a pauseAuthor: Samir Klishi

11:32 2025-03-26 UTC+2

1423

- The GBP/USD rate declined by 55 basis points on Wednesday, marking the largest drop of the current week.

Author: Chin Zhao

18:37 2025-03-26 UTC+2

1273

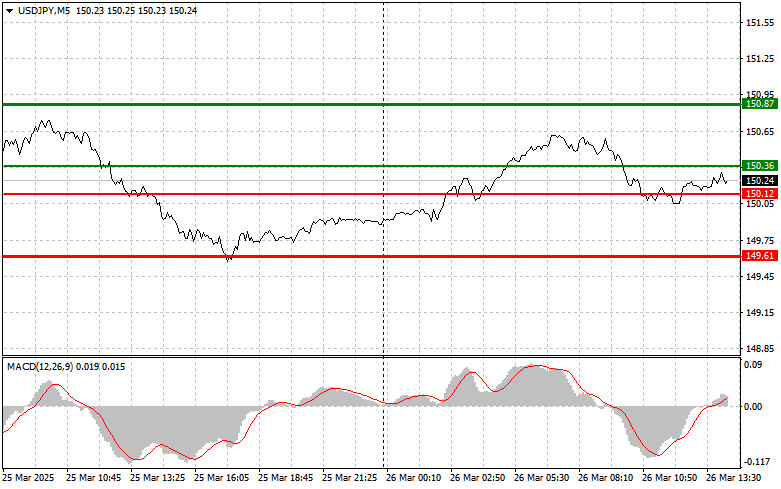

USD/JPY: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)Author: Jakub Novak

18:35 2025-03-26 UTC+2

1243

GBP/USD: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)Author: Jakub Novak

18:29 2025-03-26 UTC+2

1243

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 26-28, 2025: sell below $3,034 (21 SMA - 7/8 Murray)

Gold could continue its bearish cycle in the coming days. To confirm the downtrend, we should expect consolidation below 3,020, then the price could reach the 6/8 Murray at 2,968, and eventually reach the 200 EMA around 2,939.Author: Dimitrios Zappas

16:11 2025-03-26 UTC+2

1198

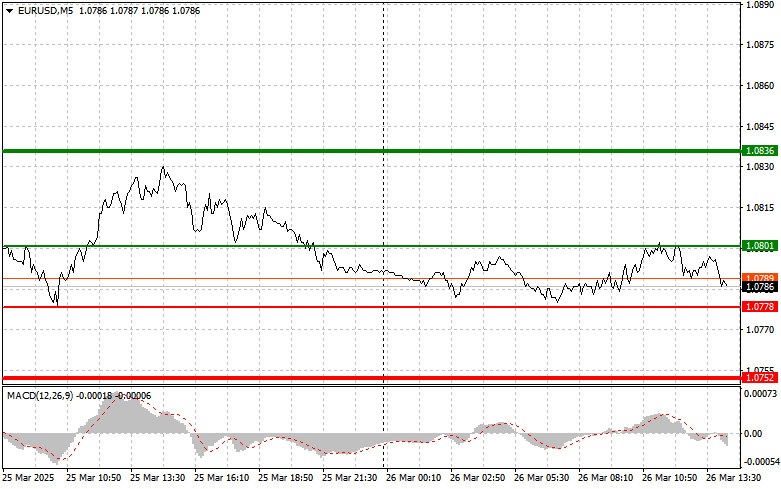

EUR/USD: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)Author: Jakub Novak

18:27 2025-03-26 UTC+2

1168

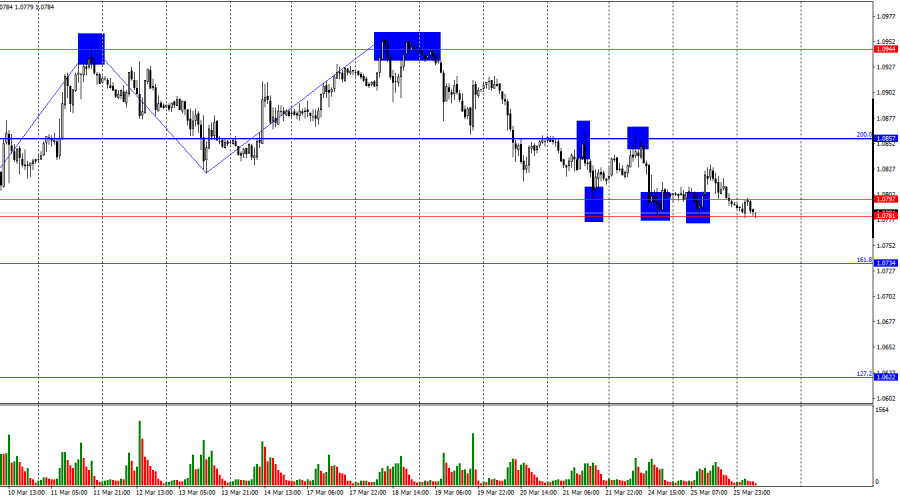

Technical analysisTrading Signals for EUR/USD for March 26-28, 2025: sell below 1.0808 (21 SMA - 8/8 Murray)

According to the H4 chart, the euro appears oversold, and we believe that if EUR/USD finds strong support around the 8/8 Murray level at 1.0742 or 1.0690, it will be seen as a buying opportunity.Author: Dimitrios Zappas

16:13 2025-03-26 UTC+2

1138

- USD/JPY. Analysis and Forecast

Author: Irina Yanina

11:42 2025-03-26 UTC+2

1588

- Gold maintains a positive tone today, but lacks strong bullish momentum

Author: Irina Yanina

11:54 2025-03-26 UTC+2

1588

- Bulls pushed for two weeks, but now it's time for a pause

Author: Samir Klishi

11:32 2025-03-26 UTC+2

1423

- The GBP/USD rate declined by 55 basis points on Wednesday, marking the largest drop of the current week.

Author: Chin Zhao

18:37 2025-03-26 UTC+2

1273

- USD/JPY: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)

Author: Jakub Novak

18:35 2025-03-26 UTC+2

1243

- GBP/USD: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)

Author: Jakub Novak

18:29 2025-03-26 UTC+2

1243

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 26-28, 2025: sell below $3,034 (21 SMA - 7/8 Murray)

Gold could continue its bearish cycle in the coming days. To confirm the downtrend, we should expect consolidation below 3,020, then the price could reach the 6/8 Murray at 2,968, and eventually reach the 200 EMA around 2,939.Author: Dimitrios Zappas

16:11 2025-03-26 UTC+2

1198

- EUR/USD: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)

Author: Jakub Novak

18:27 2025-03-26 UTC+2

1168

- Technical analysis

Trading Signals for EUR/USD for March 26-28, 2025: sell below 1.0808 (21 SMA - 8/8 Murray)

According to the H4 chart, the euro appears oversold, and we believe that if EUR/USD finds strong support around the 8/8 Murray level at 1.0742 or 1.0690, it will be seen as a buying opportunity.Author: Dimitrios Zappas

16:13 2025-03-26 UTC+2

1138