Lihat juga

03.04.2025 06:34 PM

03.04.2025 06:34 PMTrade Breakdown and Euro Trading Advice

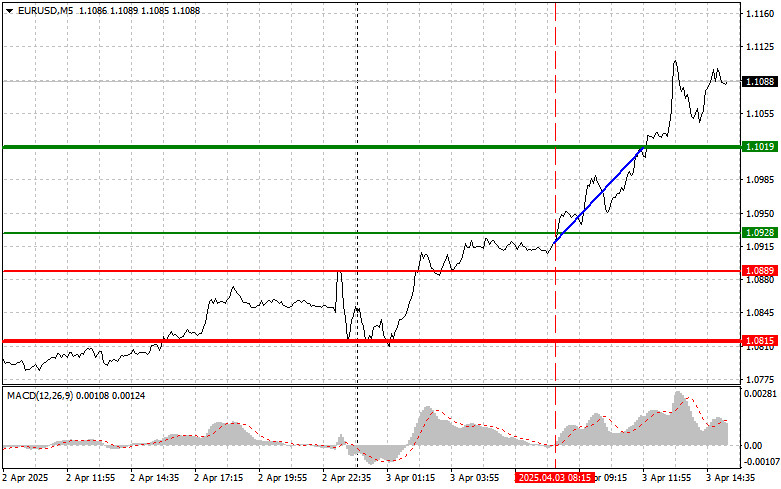

The test of the 1.0928 price level occurred just as the MACD indicator began moving up from the zero line, confirming the correct entry point for buying euros in a bullish market. As a result, the pair rose to the target level of 1.1019.

Strong data on services sector activity in the Eurozone triggered heavy euro buying. The services PMI index exceeded expectations, indicating the region's economic resilience despite global challenges. This boosted investor confidence in the euro's prospects and triggered a wave of buy orders. The improvement in economic indicators also reduced pressure on the European Central Bank to further ease monetary policy. Previously, concerns about slowing economic growth had led analysts to speculate that the ECB might implement additional stimulus measures.

During today's U.S. session, several reports will be released, including weekly initial jobless claims, the trade balance, and the ISM Services PMI. These data points are expected to influence the dollar's movement. Traders will closely analyze the figures for insights into the state of the U.S. economy and the outlook for Federal Reserve policy — especially in light of the tariffs introduced yesterday by Donald Trump. Weak data would be a reason to continue selling the dollar.

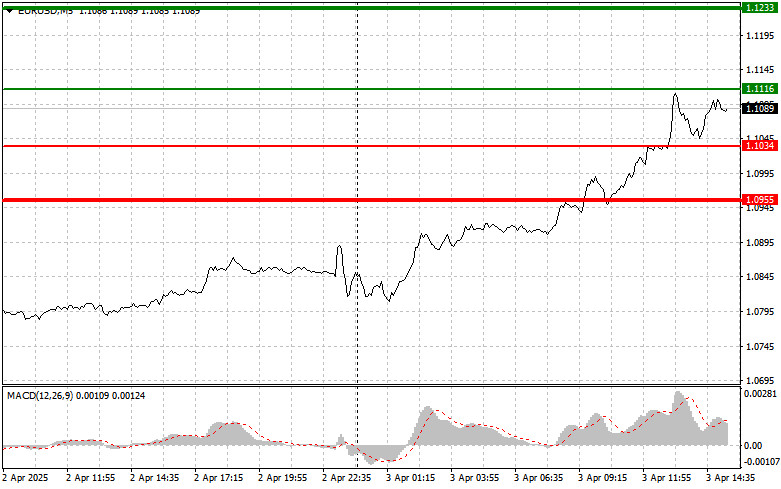

As for the intraday strategy, I will focus on executing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Buy the euro today upon reaching the 1.1116 level (green line on the chart) with a target of 1.1233. At 1.1233, I plan to exit and sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. You can count on further euro growth today as part of the ongoing uptrend, especially if U.S. data is weak and Fed officials issue dovish comments. Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: Also consider buying the euro after two consecutive tests of the 1.1034 price level when MACD is in the oversold zone. This will limit the downward potential and could trigger a reversal to the upside. You can expect a rise to the opposite levels of 1.1116 and 1.1233.

Scenario #1: Sell the euro after reaching the 1.1034 level (red line on the chart). The target will be 1.0995, where I will exit and immediately open a long position (expecting a 20–25 point bounce). It's unlikely that bearish pressure will return today. Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: Also consider selling the euro if the price tests 1.1116 twice in a row while the MACD is in the overbought zone. This will limit the pair's upward potential and may lead to a reversal down toward 1.1034 and 1.0995.

Chart Explanation

Important Reminder for Beginners:

Forex beginners should make entry decisions with caution. It's best to stay out of the market before the release of key fundamental reports to avoid sharp price swings. If you decide to trade during news releases, always set Stop Loss orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes.

And remember: successful trading requires a clear plan, like the one above. Making spontaneous decisions based on current market movements is an inherently losing strategy for intraday traders.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Analisis Trading dan Kiat-kiat Strategi untuk Yen Jepang Pengujian pertama pada level 142,66 terjadi ketika indikator MACD sudah turun secara signifikan di bawah garis nol, yang membatasi potensi penurunan pasangan

Analisis dan Kiat-kiat untuk Trading Pound Inggris Uji level 1,3286 terjadi ketika indikator MACD sudah bergerak jauh di atas level nol, yang menurut saya membatasi potensi kenaikan pound. Oleh karena

Ulasan Trading dan Tips untuk Trading Euro Pengujian level 1.1361 terjadi pada saat indikator MACD sudah bergerak jauh di atas tanda nol, membatasi potensi kenaikan pasangan ini. Oleh karena

Uji level 142,32 terjadi ketika indikator MACD sudah bergerak jauh di atas level nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Karena alasan ini, saya tidak membeli dolar

Pengujian harga pada 1,1382 di paruh kedua hari ini bertepatan dengan dimulainya pergerakan turun indikator MACD dari garis nol, mengonfirmasi titik masuk yang tepat untuk menjual euro. Akibatnya, pasangan

Uji harga di 1.3285 terjadi ketika indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang valid untuk menjual pound. Akibatnya, pasangan ini turun lebih dari

Ulasan dan Saran Trading USD/JPY Tidak ada pengujian terhadap level yang saya tandai di paruh pertama hari ini. Pada paruh kedua hari ini, investor dan trader akan fokus pada indikator

Analisis Trading dan Saran Trading untuk Pound Inggris Pengujian level 1,3325 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi entri pasar yang benar. Namun, seperti yang

Analisis Trading dan Tips untuk Trading Euro Uji level harga 1.1405 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli euro

Video pelatihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.