EURPLN (Euro vs Polish Zloty). Exchange rate and online charts.

Currency converter

28 Mar 2025 23:00

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

EUR/PLN is a popular currency pair on Forex. Poland is an active trading partner with the EU. For this reason, EUR/PLN is favoured by the experienced traders who prefer stability and predictability of the euro area and Poland economies. The most intense bidding on this financial instrument is observed during the European sessions.

EUR/PLN is the cross rate against the U.S. dollar. Although the U.S. dollar obviously is not present at this currency pair, it still has a significant influence on it. By combining EUR/USD and USD/PLN price charts, it is possible to get an approximate EUR/PLN chart.

Both currencies are affected by the U.S. dollar, that is why it is better to monitor such U.S. indices as discount rate, GDP, unemployment, new created workplaces and other to correctly predict the further movement of the pair. Is necessary to note that the discussed currencies can react differently to the changes observed in the U.S. economy, therefore, EUR/PLN may be a specific indicator for these currencies.

Poland is going to introduce the euro in near future. At the same time, there are numerous internal problems that exist in the country (the budget deficit, high external debt, etc.) as well as the global economic crisis that prevent it from adopting the European currency on schedule. The European Central Bank announced strict conditions for the euro adoption. Thus, Poland will be able to join the euro area after fulfilling all the requirements.

Poland is a developed industrial country with high living standards. The main economic sectors are engineering, metallurgy, chemical and coal industries. Poland has robust automotive and shipbuilding industries at the shipyards of the Baltic Sea. The country is rich in mineral resources: coal, copper, lead, natural gas, etc. Due to the great amount of hydrocarbons, Polish economy is fully supplied with electricity. The factors that could affect the Polish zloty significantly are the country's international rating as well as the state of Polish and European leading industries.

If you trade cross rates, remember that brokers usually set a higher spread on such pairs compared to the majors. So before you start working with the cross rates, it get acquainted with the conditions offered by the broker to trade with specified trade instrument.

See Also

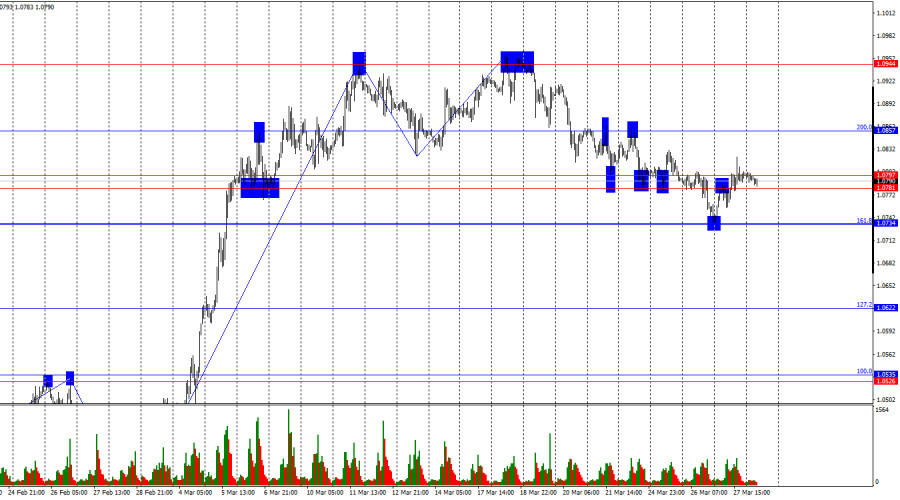

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

928

Donald Trump is not the only one to blame for the S&P 500's decline.Author: Marek Petkovich

09:19 2025-03-28 UTC+2

838

Bears are trying to break through the bulls' defensesAuthor: Samir Klishi

11:36 2025-03-28 UTC+2

838

- AUD/USD extends its range around 0.6300 ahead of the U.S. PCE Price Index

Author: Irina Yanina

12:16 2025-03-28 UTC+2

823

As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframesAuthor: Evangelos Poulakis

10:09 2025-03-28 UTC+2

793

EUR/USD. Analysis and ForecastAuthor: Irina Yanina

11:45 2025-03-28 UTC+2

793

- Auto tariffs have shaken the market: stocks are under pressure, while gold is gaining. Investors are pulling out of the auto sector as recession fears intensify

Author: Irina Maksimova

12:24 2025-03-28 UTC+2

793

Technical analysisTrading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

748

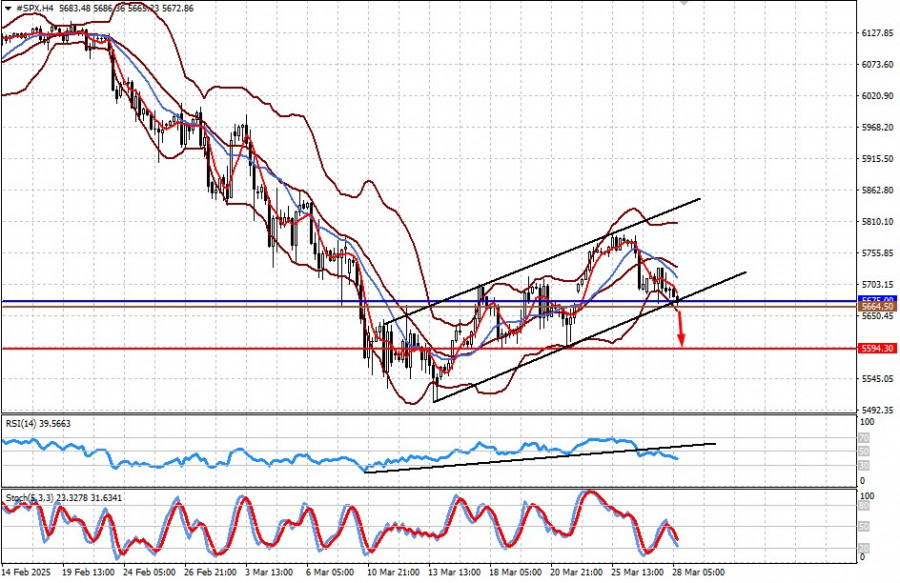

Fundamental analysisMarkets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)

Markets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)Author: Pati Gani

11:39 2025-03-28 UTC+2

748

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

928

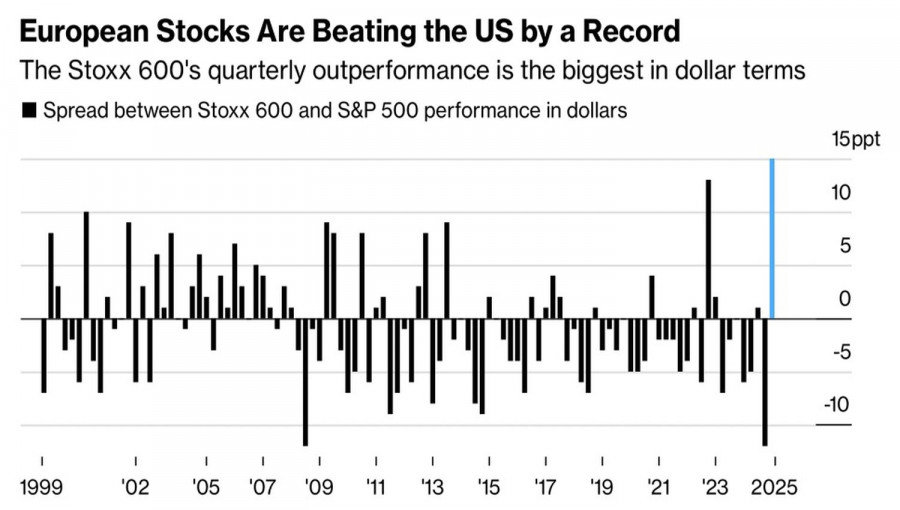

- Donald Trump is not the only one to blame for the S&P 500's decline.

Author: Marek Petkovich

09:19 2025-03-28 UTC+2

838

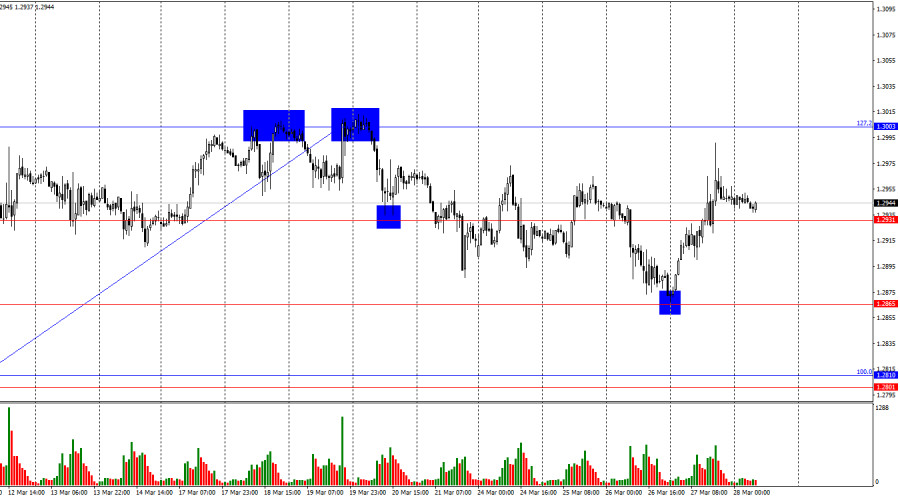

- Bears are trying to break through the bulls' defenses

Author: Samir Klishi

11:36 2025-03-28 UTC+2

838

- AUD/USD extends its range around 0.6300 ahead of the U.S. PCE Price Index

Author: Irina Yanina

12:16 2025-03-28 UTC+2

823

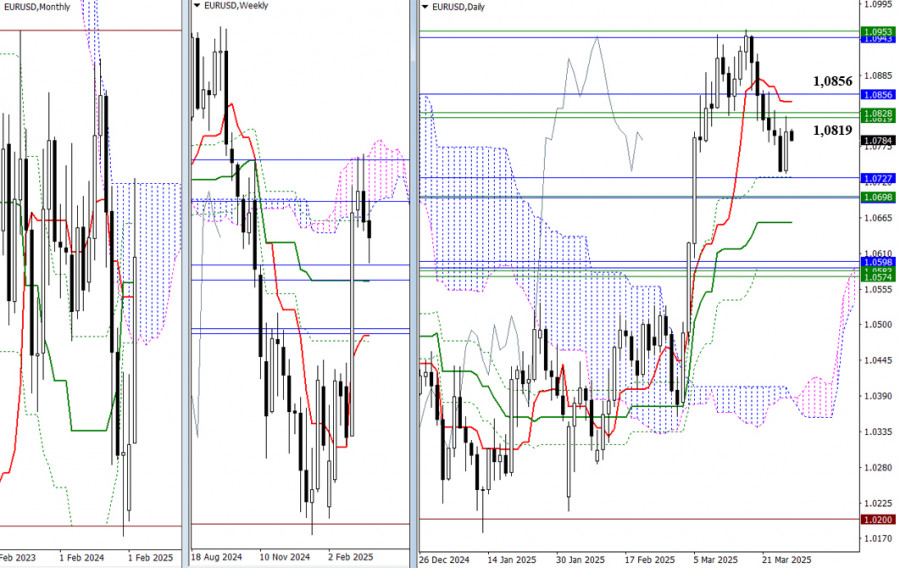

- As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframes

Author: Evangelos Poulakis

10:09 2025-03-28 UTC+2

793

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

793

- Auto tariffs have shaken the market: stocks are under pressure, while gold is gaining. Investors are pulling out of the auto sector as recession fears intensify

Author: Irina Maksimova

12:24 2025-03-28 UTC+2

793

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

748

- Fundamental analysis

Markets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)

Markets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)Author: Pati Gani

11:39 2025-03-28 UTC+2

748