CADDKK (Canadian Dollar vs Danish Krone). Exchange rate and online charts.

Currency converter

31 Mar 2025 00:25

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/DKK currency pair is not really popular among the traders of Forex market. This pair is the cross rate against the U.S. dollar. Although there is no U.S. Dollar in this currency pair, the CAD/DKK pair is under considerable influence of it. To make it clear, just combine two charts (CAD/USD and USD/DKK) in the same price chart and you will get an approximate the CAD/DKK chart.

The U.S. dollar affects both currencies deeply. That is why for better forecasting the future CAD/DKK rate, it is necessary to pay attention to the main economic indicators of the U.S. There are some indicators such as the interest rate, GDP, unemployment, new workplaces indicator and many others. These two currencies can react differently to the U.S. economy changes.

The world oil prices have a great influence on the Canadian dollar. As you know, Canada has the status of one of the largest world exporters of oil. So when the oil price is getting higher, the Canadian dollar value is also increasing, and vice versa. The fact speaks for itself: the CAD/DKK currency pair is directly dependent on the world oil prices.

Denmark is known as prosperous country with developed industrial and agricultural sectors. Its economic indicators are one of the highest in the world. Despite of the Danish large oil and gas reserves (in Jutland and in the North Sea), it is still dependent on export of other mineral resources. Denmark has stable economic and trade relationships with all the developed countries, mostly with the EU ones. They lead the active trade in machinery, electronics, agriculture, mining, etc.

That fact that the economy of Denmark is one of the strongest in the world allows the Danish krone to be stable in pairs with other major currencies on Forex market. There are some factors strengthening the Denmark economy such as low inflation and unemployment rates, large oil and gas reserves, high technology and highly qualified specialists in economic fields.

The economy of Denmark has one of the highest levels, but there are still some factors that make it weaker, such as high taxes and deterioration of the competitiveness on the world market. Traders working with this currency pair should take into account some economic indicators like prices for oil and for other minerals that can influence Denmark production.

Keep in mind that the spread for cross currency pairs can be higher than for popular ones. So before you start dealing with the cross rates, learn carefully broker’s conditions of trading with specified trade instrument.

See Also

- Technical analysis / Video analytics

Forex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

2248

Technical analysisTrading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

2143

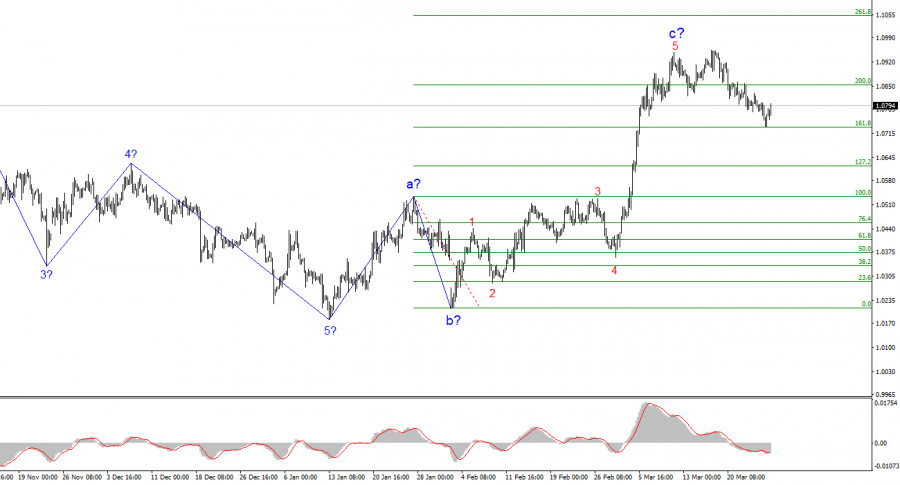

Bulls have been attacking for two weeks, but they've run out of steamAuthor: Samir Klishi

11:48 2025-03-28 UTC+2

2128

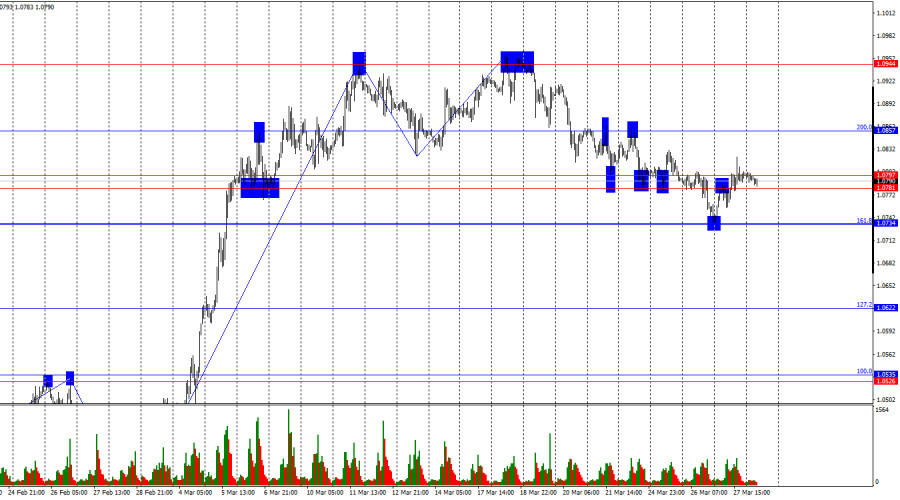

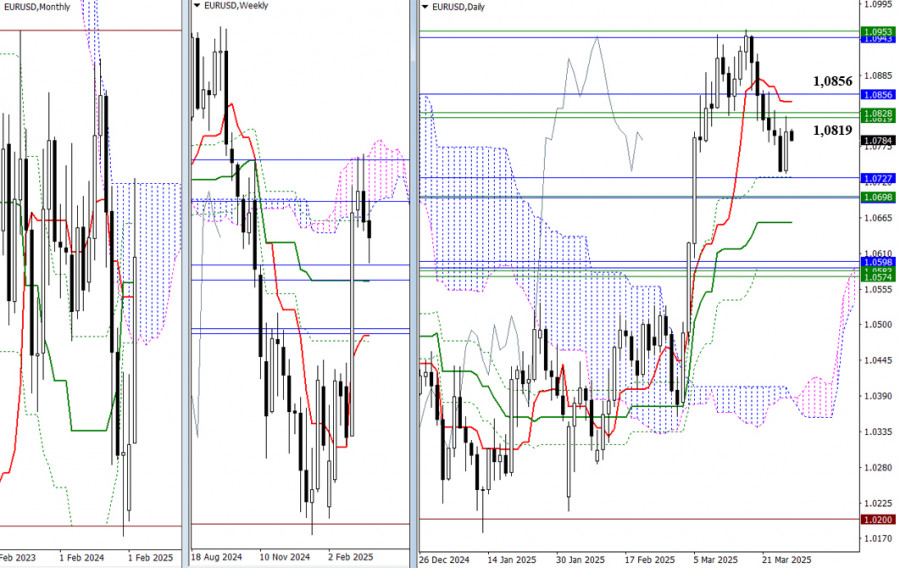

- The EUR/USD pair rose by 60 basis points over the course of Thursday.

Author: Chin Zhao

20:10 2025-03-28 UTC+2

2008

EUR/USD. Analysis and ForecastAuthor: Irina Yanina

11:45 2025-03-28 UTC+2

1828

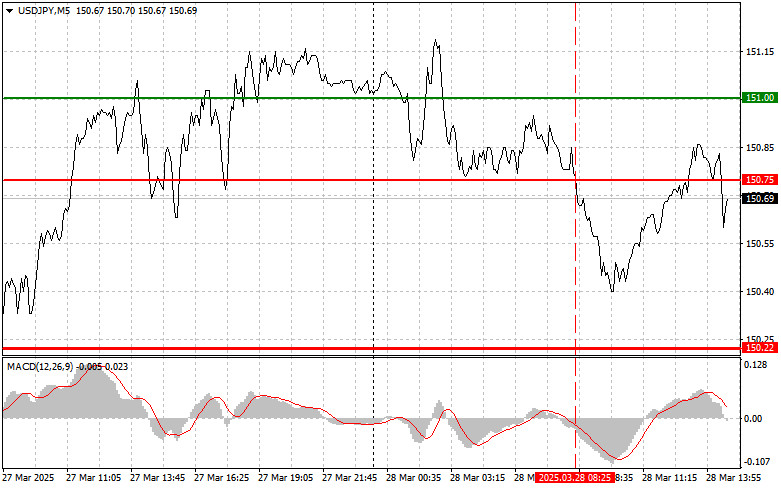

USDJPY: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)Author: Jakub Novak

20:04 2025-03-28 UTC+2

1813

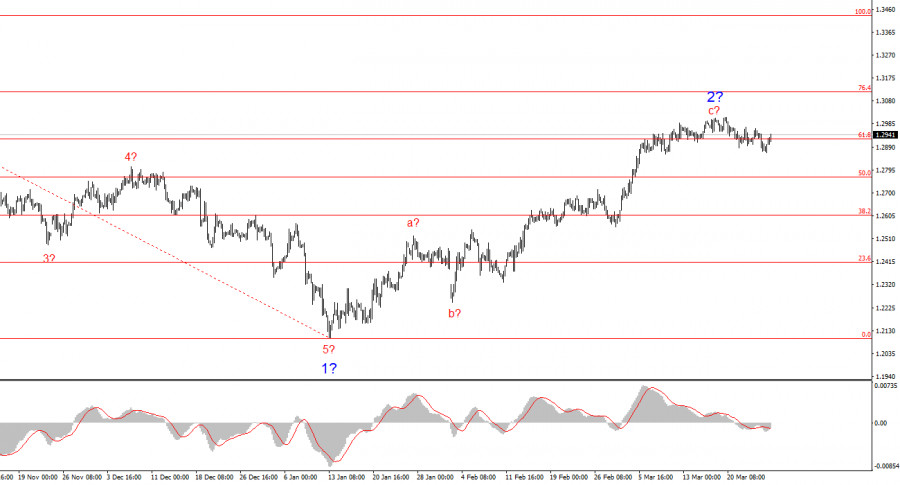

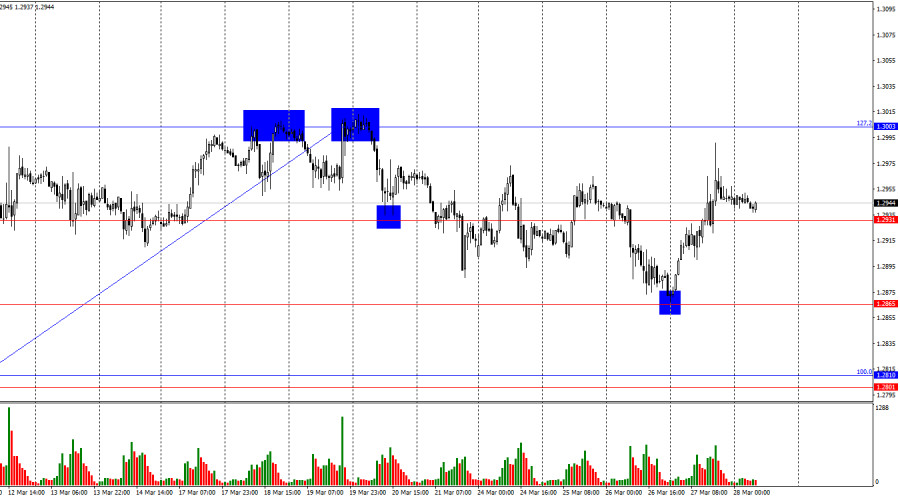

- The GBP/USD pair rose by 70 basis points on Thursday and added a symbolic 10 points on Friday.

Author: Chin Zhao

20:07 2025-03-28 UTC+2

1753

As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframesAuthor: Evangelos Poulakis

10:09 2025-03-28 UTC+2

1723

Bears are trying to break through the bulls' defensesAuthor: Samir Klishi

11:36 2025-03-28 UTC+2

1693

- Technical analysis / Video analytics

Forex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

2248

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

2143

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

2128

- The EUR/USD pair rose by 60 basis points over the course of Thursday.

Author: Chin Zhao

20:10 2025-03-28 UTC+2

2008

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

1828

- USDJPY: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)

Author: Jakub Novak

20:04 2025-03-28 UTC+2

1813

- The GBP/USD pair rose by 70 basis points on Thursday and added a symbolic 10 points on Friday.

Author: Chin Zhao

20:07 2025-03-28 UTC+2

1753

- As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframes

Author: Evangelos Poulakis

10:09 2025-03-28 UTC+2

1723

- Bears are trying to break through the bulls' defenses

Author: Samir Klishi

11:36 2025-03-28 UTC+2

1693