See also

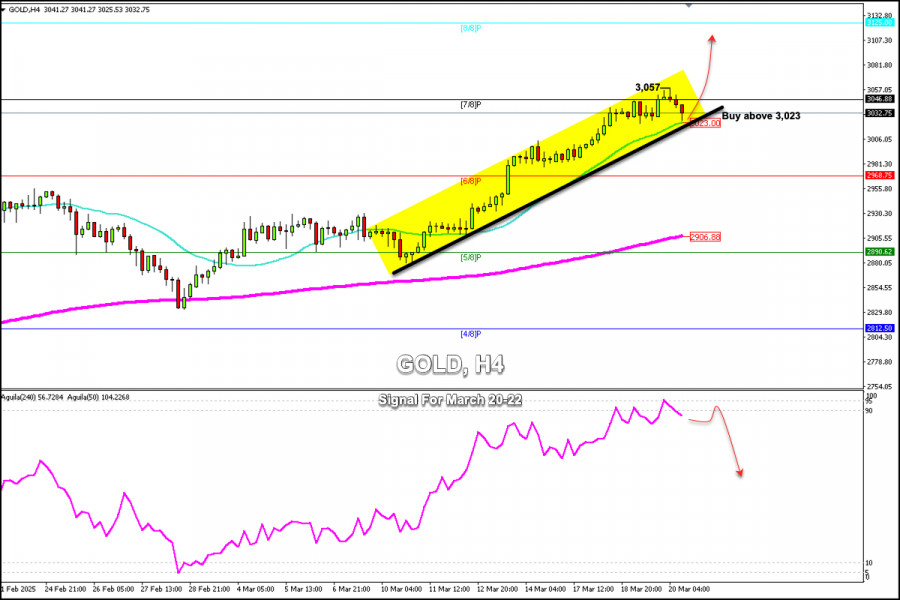

Early in the American session, gold is trading around 3,032, undergoing a strong technical correction after reaching a new all-time high around 3,057.

Despite selling pressure from profit-taking, it could resume its bullish cycle if the price consolidates above the 21 SMA located around 3,023 in the coming days.

On the H4 chart, we can see that gold is still within an uptrend channel forming since March 10, which means that after a technical correction, traders could buy gold again. Regarding technical levels, we can see that gold has strong resistance around 3,062. Breaking above this level, the instrument could reach the 8/8 Murray level at 3,125.

A consolidation below 3,023 (21 SMA) and a breakout of the uptrend channel could change the outlook for gold in the short term.

We could see a technical correction towards the psychological level of $3,000 during which the metal could even reach the 6/8 Murray level located around 2,968.

The eagle indicator is now giving a negative signal. So, as long as the gold price remains below $3,057, any technical rebound will be seen as a selling opportunity.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.