See also

11.04.2024 09:41 AM

11.04.2024 09:41 AMConsumer price growth accelerated from 3.2% to 3.5%, slightly higher than the expected 3.4%. This resulted in dollar rising sharply, as the Fed may raise the refinancing rate in the summer, since inflation continues to increase, and at a faster pace than forecasted. However, most market players lean towards the idea that interest rates will start to decrease in the autumn, although this may soon be revised.

For now, a slight retreat could be seen in the market, while dollar will likely continue to rise actively. The results of the upcoming ECB meeting may be the cause of dollar's further appreciation, as the committee may specify the timing of its policy easing. After all, inflation in Europe slowed down, approaching the target level of 2.0%.

EUR/USD hit the weekly low last week during the downward movement driven by the US inflation data. However, such an intensive price change indicates a possible overheating of short positions, which could lead to a retracement or stagnation. The possibility of such a development, however, appears to be small, as today's ECB meeting may provoke speculative price jumps.

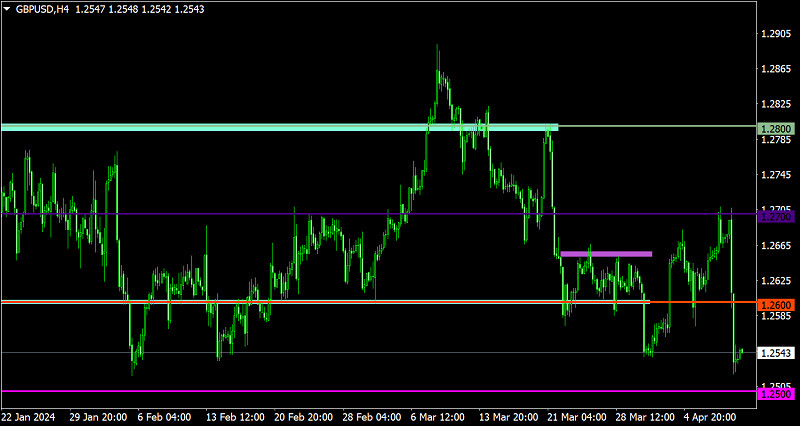

In GBP/USD, the intensive decline in quotes brought the price closer to the support level of 1.2500. Although the movement slowed down, the speculative sentiment remains. Dropping below the level will likely increase the volume of short positions. Otherwise, the level of 1.2500 may act as support.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Tuesday's Trades 1H Chart of GBP/USD The GBP/USD pair declined rather significantly on Tuesday. While the pound's drop began somewhat sluggishly, in the evening, Donald Trump finally decided

Analysis of Tuesday's Trades 1H Chart of EUR/USD The EUR/USD currency pair showed a relatively substantial decline on Tuesday. Euro quotes fell almost throughout the day, with the move intensifying

On Tuesday, the GBP/USD currency pair showed very low volatility and a general lack of interest in trading. While the euro traded with a noticeable decline, the British pound mostly

The EUR/USD currency pair traded lower on Tuesday. Once again, volatility was far from low, which might suggest the presence of significant events or news during the day. However, there

In my morning forecast, I highlighted the 1.1485 level as a key decision point for market entry. Let's look at the 5-minute chart and examine what happened. The pair dipped

Analysis of Monday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade with substantial gains throughout Monday. On the first trading day of the week, there were

Analysis of Monday's Trades 1H Chart of EUR/USD The EUR/USD currency pair started Monday with a sharp rally. Overnight, the euro appreciated by 100–120 pips, and the pair traded more

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.