See also

14.03.2024 09:04 AM

14.03.2024 09:04 AMEurope currently faces deindustrialization as the pace of its decline reached a staggering 6.7%. This confirms previous forecasts that the rising cost of energy sources in the region will result in serious economic consequences. However, the market did not react immediately, with dollar even falling in price, albeit slightly. It seems that the market halted movement ahead of the meeting of the Federal Open Market Committee, which will take place next week. Most likely, today's data from the US will also be ignored, as jobless claims, for instance, will increase by only about 7,000. Retail sales, which exert significant influence on economic dynamics, will also rise from 0.6% to 1.0%. In theory, this should lead to a strengthening of dollar, but since even inflation failed to move the market, expecting anything different from retail sales appears to be challenging.

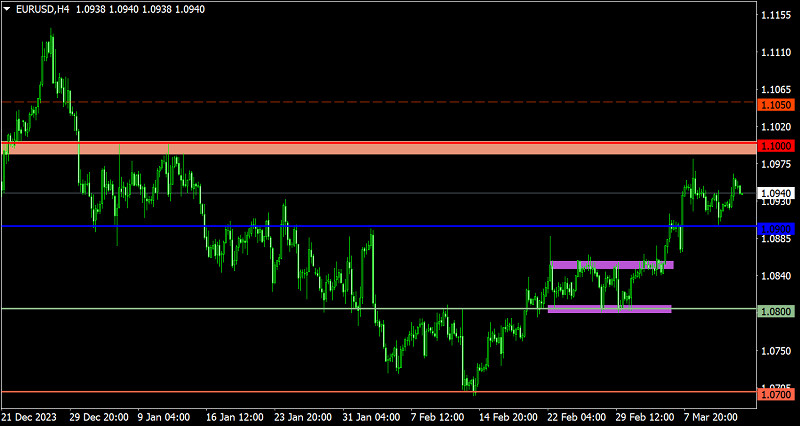

EUR/USD currently trades upward, indicating a clear speculative sentiment among market players. Despite several factors suggesting a further increase, the resistance area of 1.0950/1.1000 remains unbroken, so subsequent fluctuations at the peak of the upward cycle may still occur.

GBP/USD showed a partial recovery relative to the current correction. However, the level of 1.2800, acting as resistance, negatively affects the volume of long positions. Further growth will be seen only if the price stabilizes above this level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In my morning forecast, I highlighted the level of 1.1393 and planned to make entry decisions based on it. Let's look at the 5-minute chart and analyze what happened there

Analysis of Friday's Trades 1H Chart of EUR/USD On Friday, the EUR/USD currency pair generally continued upward movement. And why would it stop? The trade war between the U.S

The GBP/USD currency pair continued trading higher on Friday, although the dollar avoided substantial losses this time. Even though one day without a complete dollar collapse may seem significant

On Friday, the EUR/USD currency pair continued its ultra-strong rally—something no one was surprised by anymore. U.S. and China reciprocal tariffs continue to rise, while all other news remains irrelevant

In my morning forecast, I highlighted the level of 1.2986 and planned to make market entry decisions from that point. Let's take a look at the 5-minute chart and break

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair resumed its upward movement and posted a gain of more than 300 pips. As Friday began

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.