See also

30.09.2022 11:05 AM

30.09.2022 11:05 AMThe final data on the GDP of the United States for the second quarter coincided with preliminary estimates. Thus, their influence on the market was reduced to zero.

Together with the GDP data, weekly jobless claims figures were released, which fell significantly. This is a positive factor for the US labor market, which led to a local strengthening of dollar positions at the time of the release of statistics.

Statistics details:

The volume of continuing claims for benefits fell from 1.376 million to 1.347 million.

The volume of initial claims for benefits fell from 209,000 to 193,000.

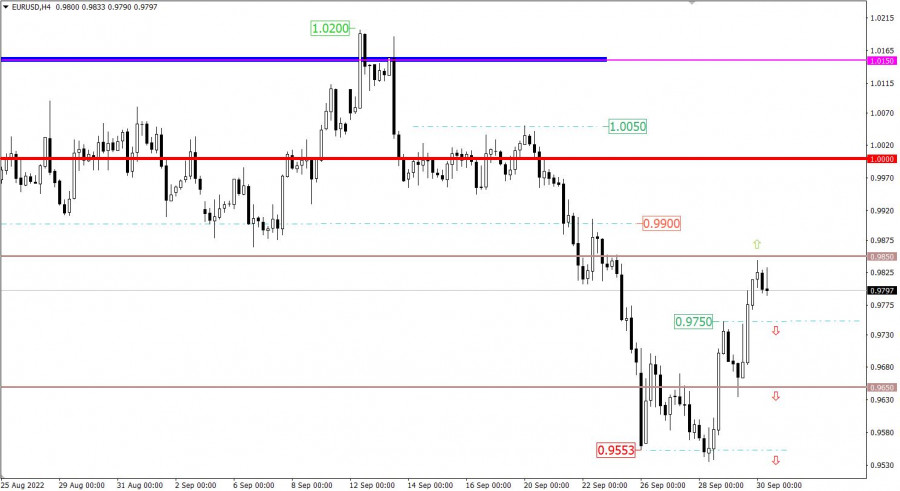

The EURUSD currency pair is in correction from the local low of the downward trend. As a result, euro positions strengthened in value by about 3.2%, which is about 300 points. Despite the fact that the volume of the upward movement is considerable, the euro is still cheap.

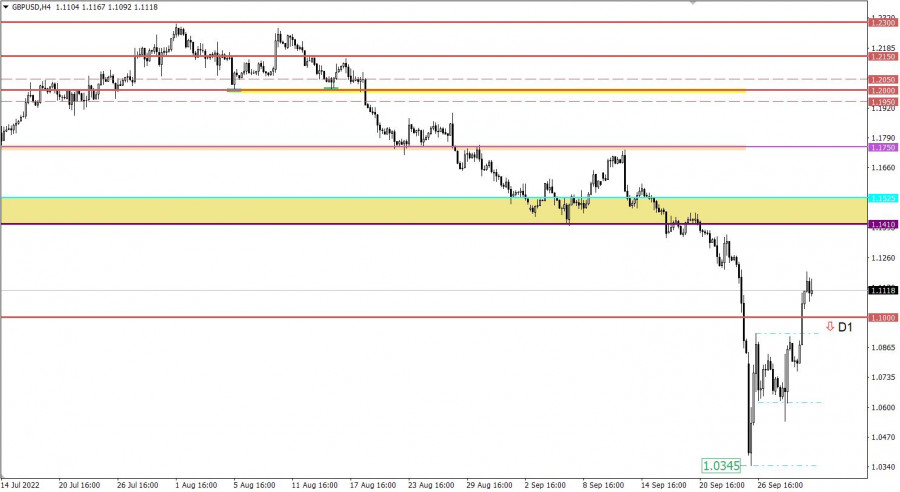

The GBPUSD currency pair completed the amplitude movement in the range of 1.0630/1.0930 by breaking its upper limit. As a result, there was a technical signal about a prolonged corrective move from the low of the downward trend.

At the opening of the European session, the final data on UK GDP for the second quarter were published, which gave a pleasant surprise. GDP for the second quarter grew by 0.2% compared to the previous forecast of -0.1%, and in annual terms increased to +4.4% against the previous estimate of 2.9%.

In Britain, data on the lending market will also be published, where a widespread decline is predicted. This is not the best signal for the country's economy. Let's see if the forecasts match.

The European Union expects the publication of preliminary data on inflation, which is predicted to rise from 9.1% to 9.7%. Rising consumer prices again indicate that the ECB is not tightening monetary policy sufficiently. In fact, with the growth of inflation, a signal about a further increase in interest rates is likely.

In this case, the euro may continue to strengthen.

Time targeting:

UK lending market – 08:30 UTC

EU Inflation – 09:00 UTC

Preservation of the corrective move on the market may well return the quote to the parity level. A technical signal about further growth will appear after the price holds above the level of 0.9850.

Traders will considere the downward scenario if the price stays below the value of 0.9750.

It is worth noting that the market has been heavily subject to speculation lately. For this reason, chaotic price jumps may occur, in which signals from technical analysis will be ignored.

The scale of the strengthening of the pound sterling is almost comparable to the recent collapse. Even though the pound is still oversold when viewed in the medium and long term. Thus, the preservation of the current correction on the market may lead to a subsequent strengthening of the British currency to the area of 1.1410/1.1525.

An alternative scenario in which the downward cycle could resume will be considered by traders after holding the price below the 1.1000 level in the daily period.

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade upward on Thursday despite the absence of any objective reasons for such movement. There were

On Thursday, the GBP/USD currency pair continued to trade in the "euro style." The intraday movements were relatively weak, and the technical picture suggests the trend might shift downward

The EUR/USD currency pair traded much more calmly on Thursday than during the first half of the week, and the market was also relatively more technical. Since the beginning

Analysis of Wednesday's Trades 1H Chart of GBP/USD On Wednesday, the GBP/USD pair closely followed the movements of the EUR/USD pair, further confirming that the current situation hinges

Analysis of Wednesday's Trades 1H Chart of EUR/USD On Wednesday, the EUR/USD currency pair traded in a mixed manner. During the day, the price changed direction several times, and macroeconomic

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.