See also

19.09.2022 11:31 AM

19.09.2022 11:31 AMRetail sales fell 1.6% on a monthly basis in August, according to the UK Office for National Statistics (ONS). This is the most significant decline since December 2021. On an annualized basis, sales fell 5.4% after falling 3.2% in July.

The decline in retail sales is a negative factor, which is another sign that the economy is slipping into recession.

The pound sterling was actively losing value during the publication of statistical data.

In Europe, data on inflation accelerated from 8.9% to 9.1%. The final data coincided with the preliminary estimate.

Rising inflation indicates that the ECB will once again raise the refinancing rate by 75 basis points. The expectation of further growth of the rate has a positive effect on the euro during the publication of inflation data.

The EURUSD currency pair, despite the local manifestation of activity, is still moving within the sideways range of 0.9950/1.0030. This price movement indicates the process of accumulation of trading forces, which will most likely lead to a surge in activity during the completion of the side formation.

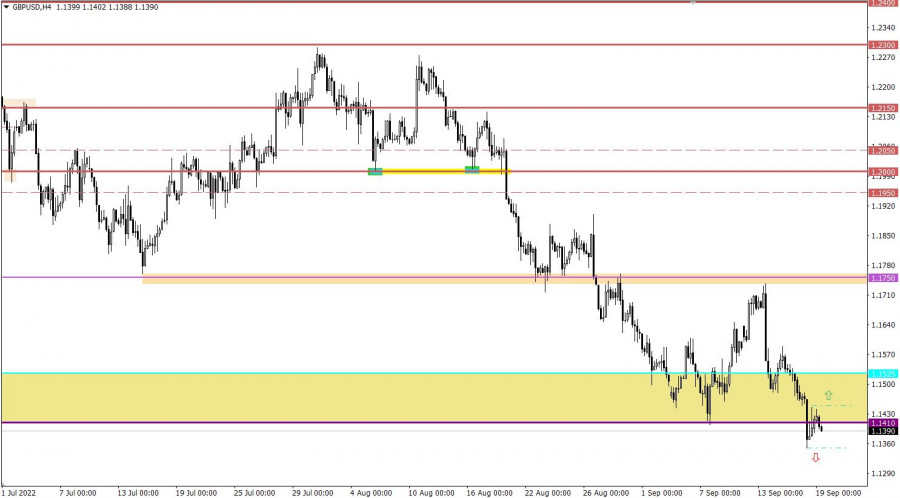

The GBPUSD currency pair ended last week with an update of the local lows of the downward trend. As a result, the quote was at the levels of 1985, where overheating of short positions on the pound led to a technical pullback of about 90 points.

The new trading week starts with a blank macroeconomic calendar. Important statistics in Europe and the United States are not expected. While trading is closed in the UK due to the funeral of Queen Elizabeth II.

Investors and traders will be guided by the information flow, identifying possible speeches / statements / comments regarding interest rates, inflation, and everything related to monetary policy.

In this situation, work within the established range is possible, but the outgoing impulse method is considered the most optimal strategy in terms of income and risk.

We concretize the above:

The downward movement will be relevant after holding the price below 0.9950 in a four-hour period. This move could result in a new downward trend low.

An upward movement in the currency pair is taken into account in case of a stable holding of the price above the value of 1.0030 in a four-hour period.

Despite the current pullback, the market still has a technical signal about the oversold pound sterling. For this reason, the price movement above the value of 1.1450 will lead to the subsequent recovery of the British currency.

At the same time, the update of the local low of the downward trend has led to the emergence of an inertial move on the market, where the speculative mood may well ignore all the emerging signals from technical analysis. In this case, keeping the price below the value of 1.1350 may lead to a subsequent increase in the volume of short positions in the pound sterling.

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Wednesday's Trades 1H Chart of GBP/USD On Wednesday, the GBP/USD pair closely followed the movements of the EUR/USD pair, further confirming that the current situation hinges

Analysis of Wednesday's Trades 1H Chart of EUR/USD On Wednesday, the EUR/USD currency pair traded in a mixed manner. During the day, the price changed direction several times, and macroeconomic

On Wednesday, the GBP/USD currency pair followed the same trend as the EUR/USD pair. The British pound also plummeted sharply overnight following two statements from Donald Trump, then quickly recovered

The EUR/USD currency pair traded in both directions throughout Wednesday, constantly changing its trajectory. The trading day began with a price collapse following Donald Trump's announcement that he would

Analysis of Tuesday's Trades 1H Chart of GBP/USD The GBP/USD pair declined rather significantly on Tuesday. While the pound's drop began somewhat sluggishly, in the evening, Donald Trump finally decided

Analysis of Tuesday's Trades 1H Chart of EUR/USD The EUR/USD currency pair showed a relatively substantial decline on Tuesday. Euro quotes fell almost throughout the day, with the move intensifying

On Tuesday, the GBP/USD currency pair showed very low volatility and a general lack of interest in trading. While the euro traded with a noticeable decline, the British pound mostly

The EUR/USD currency pair traded lower on Tuesday. Once again, volatility was far from low, which might suggest the presence of significant events or news during the day. However, there

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.